CMHC Loosens Previous Restrictions in July 2021

Déjà vu? Canada's federal mortgage insurance provider returns to its previous 2020 qualifying rules, increasing access to its insured mortgages.

CMHC loosens its insurance rules — here's why.

On July 5, 2021, the federally-owned CMHC (Canada Mortgage Housing Corporation) is easing restrictions introduced one year ago.

Last July 2020, the CMHC brought in tighter rules for accessing its insured mortgage funding — including raising both the qualifying mortgage amount and the needed credit score.

They felt at the time, as Canada's largest and most well-known mortgage default insurance provider, that their changes would help protect home buyers from the market impact of the COVID-19 pandemic. They wanted to help curtail unsustainable price growth by limiting access to high-ratio mortgages and reduce government and taxpayer risk.

But the other two private insurance companies, Sagen and Canada Guaranty, did not follow suit. So instead, banks and clients went to them for insured mortgages, diminishing CMHC's prominent position in providing Canadian home buyers with high-ratio mortgages.

One could argue that the new federal stress test regulations, introduced in June 2021, will have a bigger impact on helping to protect Canadians home buyers from taking on unsustainable mortgage debt. And that providing better access to insured mortgages helps first-time buyers get into the market during a time of lower inventory and tougher bidding competition.

Related: What is an Insured Mortgage?

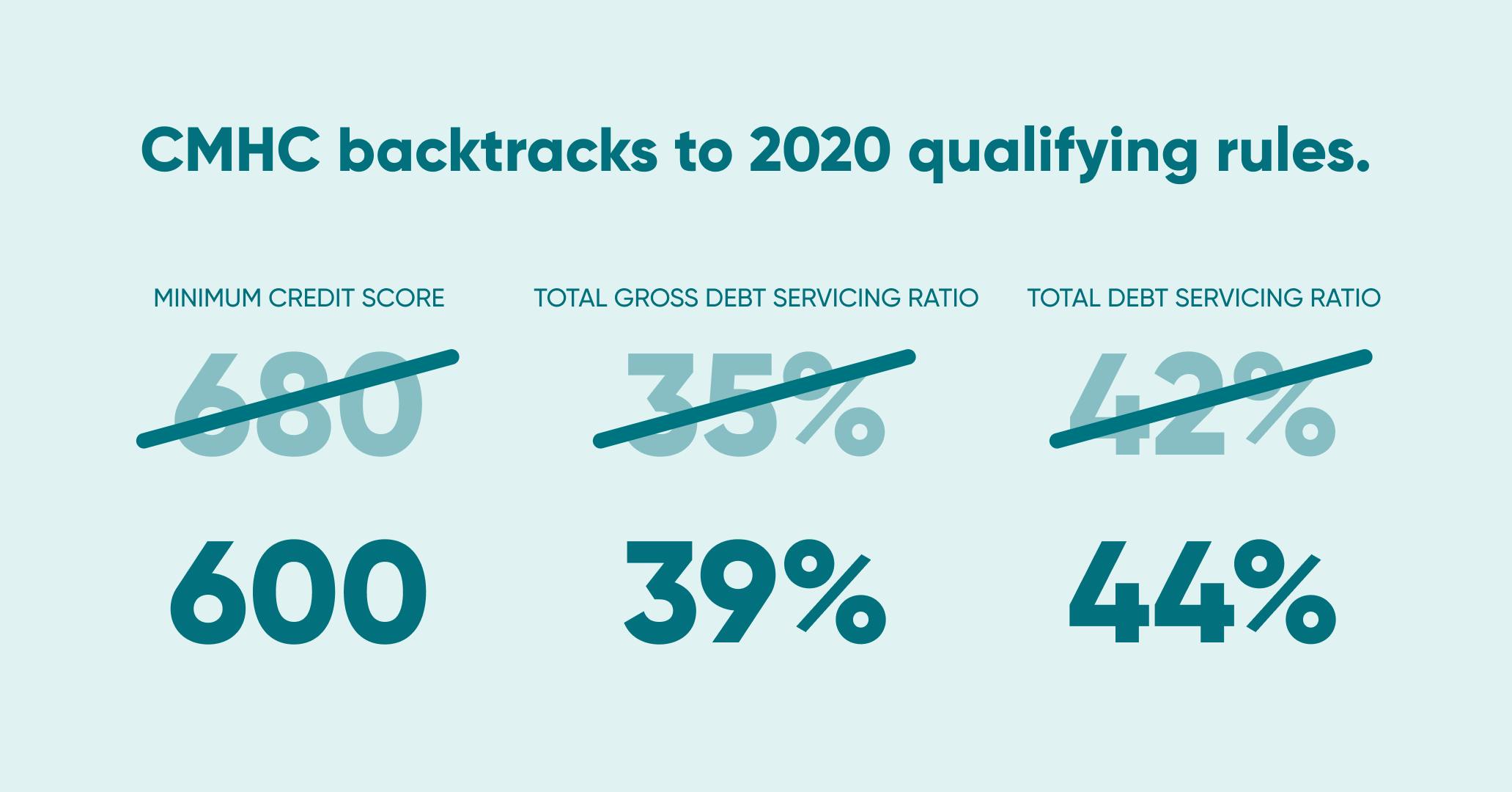

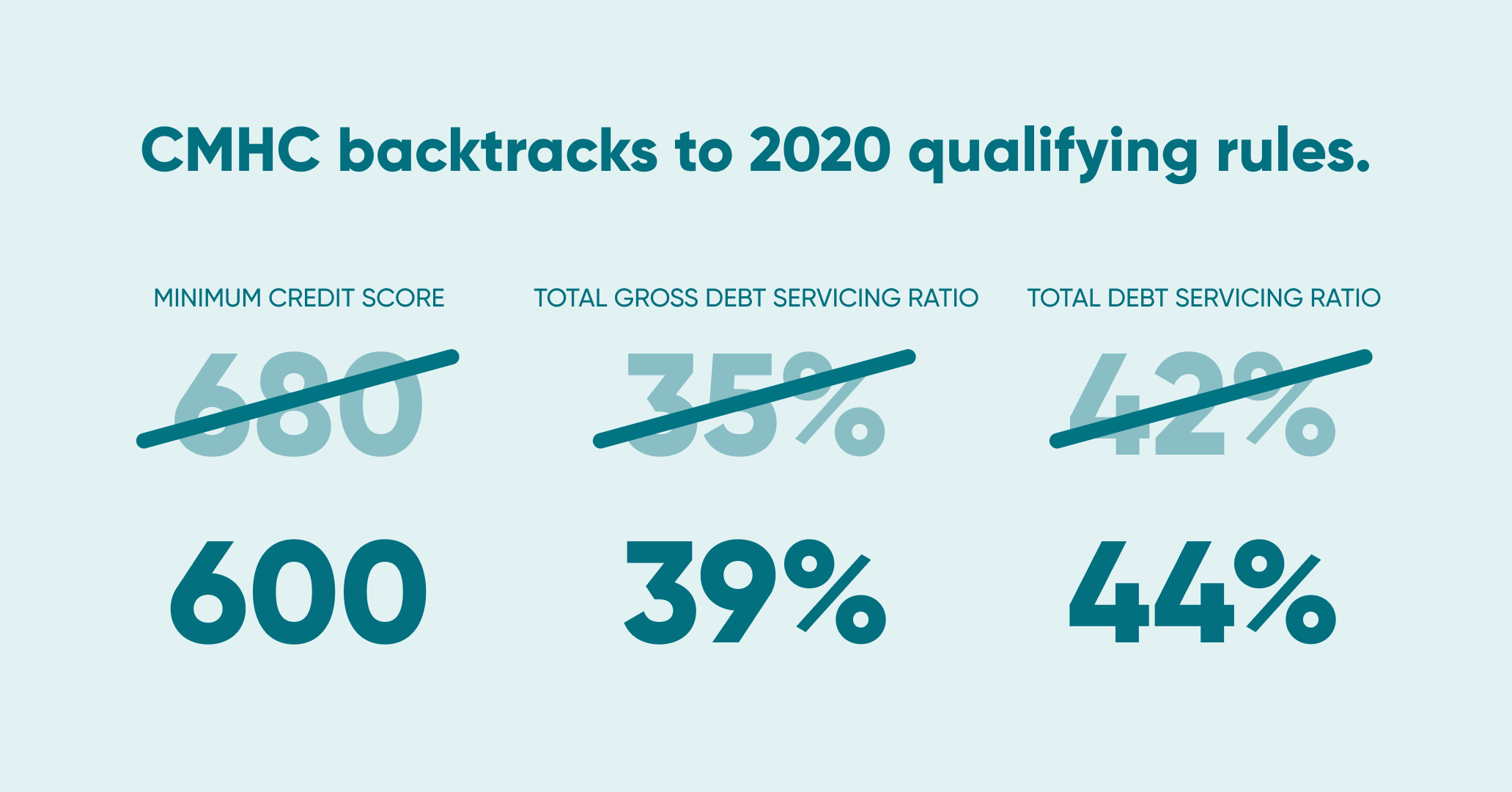

Here are the CMHC qualification rule changes:

- Minimum credit score of 600 for at least one co-applicant, lowered from 680

- Gross Debt Service (GDS) ratio up to 39% (from 35%)

- Total Debt Service (TDS) ratio up to 44% (from 42%)

As always, CMHC will consider the overall strength of a mortgage loan application when qualifying borrowers for its insurance.

Related: Credit 101

Do these CMHC insurance changes affect you?

Before the announcements of the tightening and then loosening of their default mortgage insurance requirements, CMHC insured only a small number of our mortgages. These changes will have little to no impact on our True North Mortgage clients.

Have questions about high-ratio mortgages or these CMHC changes? Give us a call, open up a chat, or drop by one of our convenient store locations — we're always here to help.

Get great mortgage advice.

More about mortgages

Proof that our rates are lower.

Our rates are 0.18% lower on average compared to everyone else. Prove it? Okay!

Learn More

Pre-Qualify in Minutes

Know before you go (house hunting, that is). Get pre-approved fast, hold your best rate.

Learn More

What is an Insured Mortgage?

Insured mortgages can mean better rates and options. Here's how they work.

Learn More