CMHC Tightens Rules

On July 1, 2020, Canada's largest default insurance provider is adding restrictions, though it will have little to no impact for our clients.

Canada Mortgage and Housing Corp (CMHC) announced on June 4, 2020 that it would tighten its rules for mortgage default insurance, coming into effect for July 1, 2020. Among these new rules, they're lowering the mortgage loan amount that can be insured, raising the credit score to qualify for CMHC insurance, and requiring homebuyers to use their own funds (not borrowed) for their down payment.

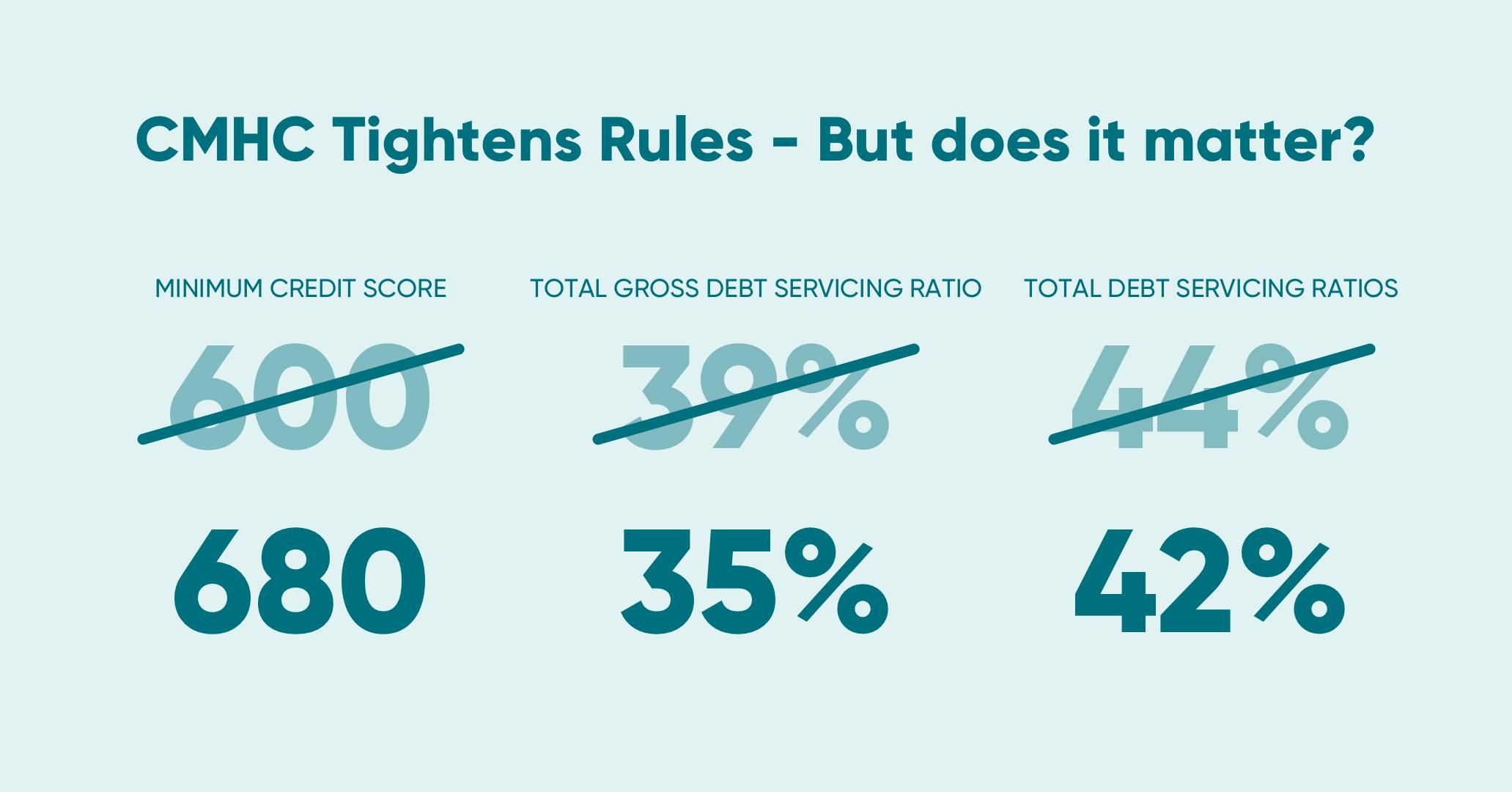

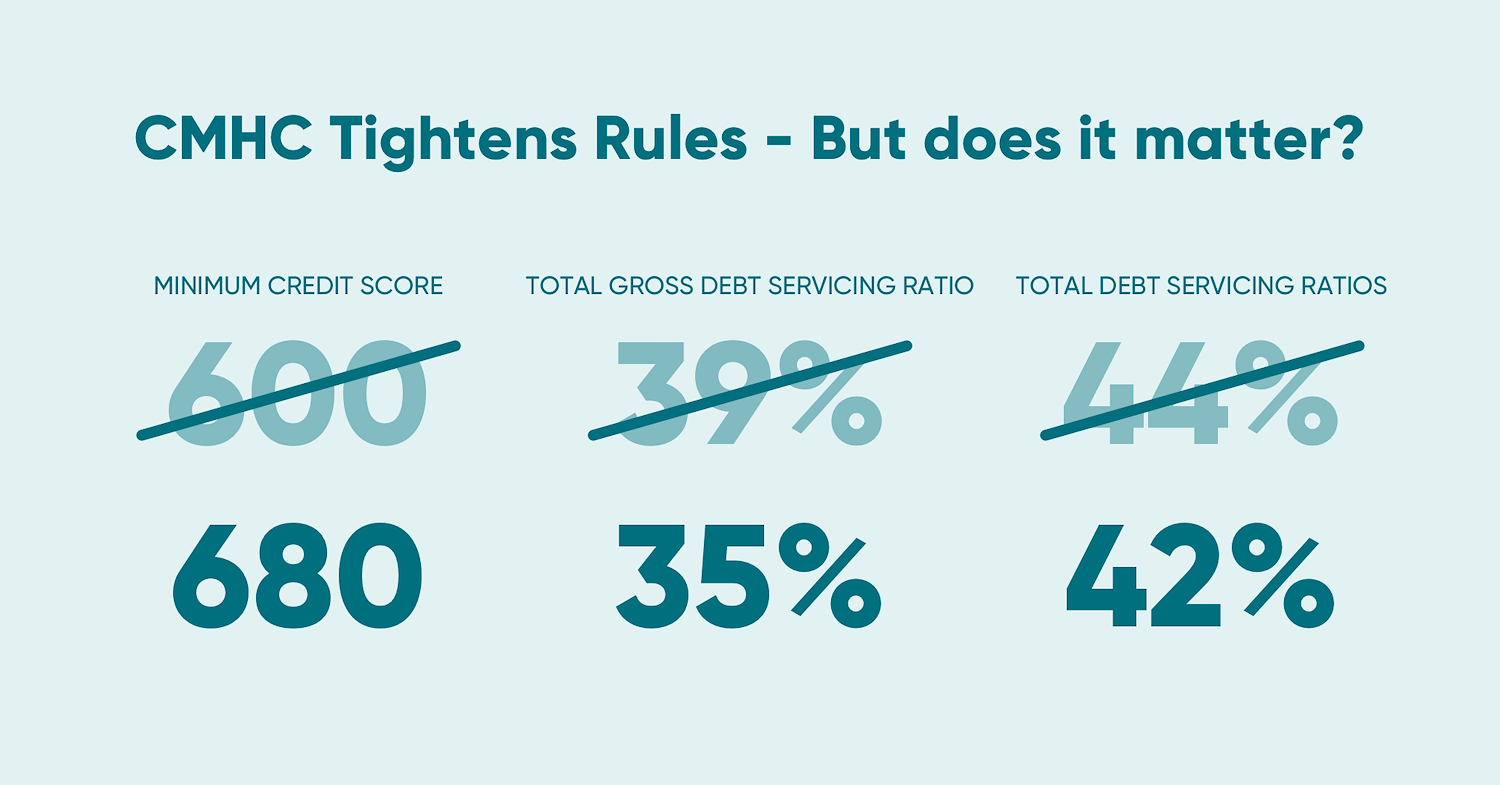

Their qualification rules for insurance have changed:

- Minimum credit score of 600 will be raised to 680

- Total gross debt servicing ratios of 39% will be lowered to 35%

- Total debt servicing ratios of 44% will be lowered to 42%

Why these changes, and why now?

CMHC, a government housing agency that insures Canadian mortgages, is making these adjustments in direct response to the impact of the COVID-19 pandemic on market conditions. They see economic vulnerabilities on the housing horizon, including decreasing house prices due to job losses and a drop in immigration. Evan Siddall, CMHC's President and CEO, also states that these changes "will help curtail excessive demand and unsustainable house price growth."

Do these insurance changes impact you?

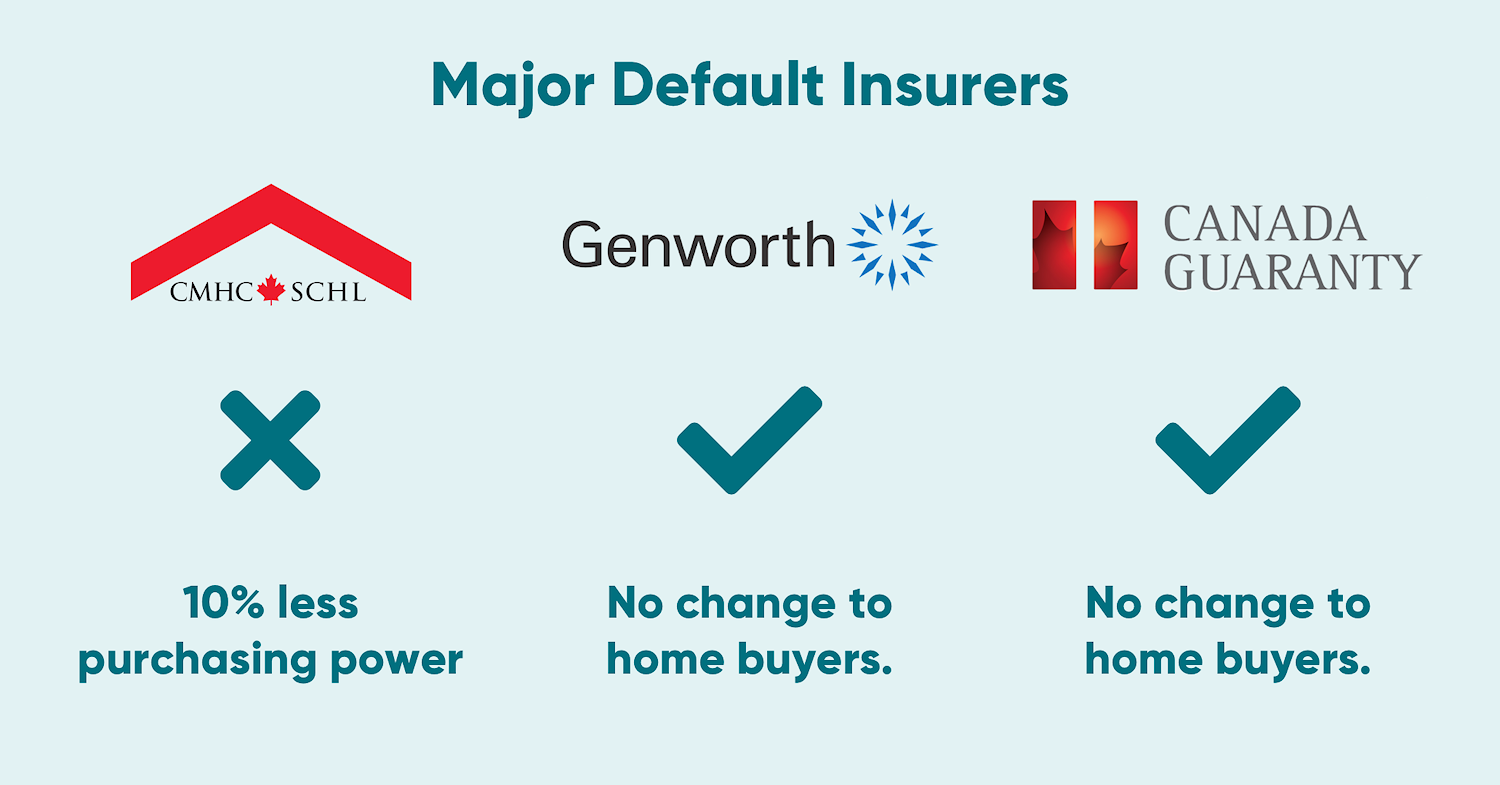

CMHC is a household name and is currently the largest default insurer in Canada. However, they are not the only option. At this point, other insurers, such as Canada Guaranty and Sagen, have stated that they are not planning to follow suit. It may be likely that going forward, CMHC will insure a smaller percentage of Canadian mortgages if there are other options for insurance.

Even before these changes were announced, CMHC insured only a small portion of our mortgages. This change will have little to no impact on our True North Mortgage clients.

Have questions about these recent CMHC changes? Or about mortgage default insurance? Give us a shout, we're here to help.

Get in touch, we quickly answer your questions.

have more mortgage questions?

What is an Insured Mortgage?

Insured mortgages can mean better rates and options. Here's how they work.

Learn More

First Time Home Buyers

Get the best start and save a pile of cash with our mortgage experts.

Learn More

Credit FAQs

Have credit questions? Here are some quick facts you should know.

Learn More