A 5-year fixed term is usually the preferred choice for our clients. During the pandemic, over 50% instead chose a much lower variable rate due to the wide spread with fixed rates at the time. Today, that trend has once again flipped, with more of our clients choosing a fixed vs variable rate.

Lowest Mortgage Rate in Canada. Starting from 2.49%

Welcome to the upside-down (of mortgage rates).

Today's Bank of Canada rate hike of 0.50% will put variable rates higher than some fixed rates (whoa).

It's happened before, but it's kind of historically rare. Here's what this spread-inversion means for your mortgage rate choices.

Time to flip over your rate?

Continuing its inflation-busting rate-hike mandate, the Bank of Canada (BoC) raised its policy rate today by another oversized hike of 0.50% to 4.25%. Some may breathe a sigh of relief to hear that the central bank 'may' pause at this rate (do we believe them??). It will bring prime rates that affect your variable-rate mortgage to 6.45% (assuming banks will follow suit).

With variable rates up even higher, fixed rates have actually trended down recently thanks to lower bond yields, flipping the typical spread relationship. It's an unusual development, as variable rates are usually lower than fixed rates due to their 'floating' risk (your mortgage interest costs change along with bank prime rate moves).

The spread inversion will likely (currently) only affect our best-rate mortgage choices:

- Our best variable rate offer after today's hike will likely be 5.25% (insured mortgages)

- Our best fixed rate is currently 4.74% (lower than our variable!!)

Does that make the fixed rate a clear choice over a variable rate?

Not necessarily. Let's take a look.

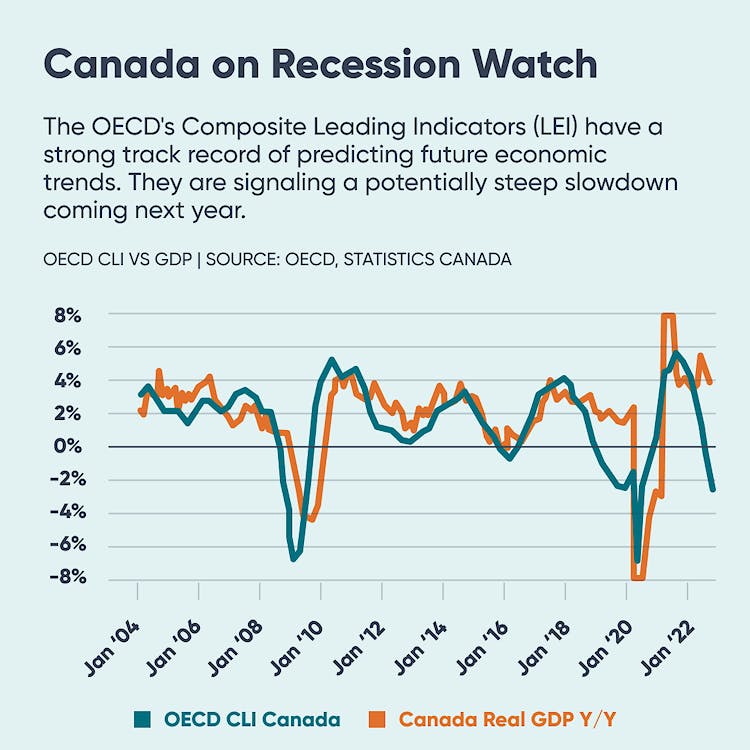

What's causing the inverted spread between the variable vs fixed rate?

The spread is inverting — or close to par — because through the bond market, the economy is reading trouble ahead (i.e. a possible recession). If interest rates are predicted to come down from their current highs, the selling and buying of bonds (measured by bond yields) are trying to anticipate those changes to mitigate future costs incurred by banks.

Despite the central bank's tense mood in fighting high inflation, the bond market's 'concern' about where interest rates may be going is keeping fixed mortgage rates on a relatively flat trend even though variable rates are now higher.

Note: The bond market is the primary influence for how banks set their fixed mortgage rates.

What does an inverted spread signal for future rates?

The flip in the spread relationship between variable and fixed rates signals that the market expects future interest rates to be lower, likely seeing a recession coming for the Canadian economy.

For the most part, fixed mortgage rates have already priced in today's hike (for a resting rate of 4.25%) though we may see a slight bump of around 0.02% as many anticipated today's hike to be smaller. Of course, the BoC may decide to keep going and post rate hikes into the spring, but at this moment, the bond market isn't seeing it, and the BoC isn't saying it (out loud).

I said months ago that we’ll know we’re near the end of the cycle when the Bank of Canada hikes rates and the bond market (and fixed mortgage rates by extension) shrugs it off. We’re at that point now. The Bank is raising the price of short-term money, but rates on longer term borrowing aren’t responding.

– Ben Rabidoux, Edge Analytics, December 2022

So if the market is looking at variable rates possibly dropping at some point, the question is, when? In 6 months? A year? Or 2 years?

Trying to predict 'when' is like trying to predict the results of the next election. Our True North Mortgage brokers try to keep on top of the latest messaging to glean where the markets may be going and how they may affect your mortgage needs.

Will you save more if you choose a fixed rate right now over a variable?

Buying a home or renewing your term? If you choose your best fixed mortgage rate — and it's lower, on par, or slightly higher than your best variable rate — your payments would be similar to those with a variable rate, but you'd also not have to worry about any rate changes until the end of your term. For some, that 'stress savings' is enough to stick with a fixed rate.

And, you may save actual cash for a time compared to a higher variable rate, as long as the spread inversion continues or if variable rates go even higher than the fixed rate you locked into.

Here's the never-ending catch with a fixed rate: variable rates may go down later, leaving you wishing that you would have gone with a variable instead. So then, it may cost you penalties and fees to switch into a lower rate at that point, or you'll be stuck paying your fixed rate for the remainder of your term (...while you also sleep soundly at night knowing your budget won't change).

Should you flip from a variable to a fixed rate?

Switching to a fixed rate may feel like the right thing to do if you can't handle the variable fluctuations in your budget. No matter what the economists say or predict, there's always a chance that variable rates will continue their upward climb. For example, if inflation refuses to budge or supply/demand conditions change for the worse (yet again). And you may want protection against the risk of even higher interest costs if your budget is already maxed out.

The flip side of sticking with your variable-rate mortgage? Many in the industry believe that the lion's share of the rate hikes is now behind us. If that turns out to be true and the central bank finally decreases its policy rate (because inflation is heading back to its 2% target or there's a recession afoot) — the budget pain you've experienced during the fastest rate hike cycle in the central bank's history may subside during your term for lower payments and some budget room. By comparison, if you do switch to a fixed rate, you won't get any rate relief until it's time to renew.

Why are fixed rates typically higher than variable rates?

Fixed rates are usually higher because you're paying a premium for the budget security that a fixed rate and fixed payments afford you during your term. Variable rates are (usually) cheaper because of the added risk of prime-rate changes and the possibility that your variable-rate mortgage payments and interest costs may also change quickly, as we've seen since March 2022.

When was the last time the spread inverted?

Even though a spread inversion between variable and fixed mortgage rates is relatively rare, we last saw cheaper fixed rates compared to variables in 2019. (Note: The onset of the 2020 pandemic threw all previous market predictions and expectations out the window, including the warning signs this spread inversion had indicated).

For months, though, fixed mortgage rates have dipped below variable rates, a rare occurrence that reflects investors’ worries about the possibility of a future recession in the U.S. and Canada – Erica Alini, Global News, Nov. 16, 2019

How long might this rate inversion last?

For now, the inverted spread may only apply to our lowest-advertised insured rates, where both fixed and variable rate choices offer the best rates.

After today's central bank hike, the inversion may last until the central bank either strongly suggests that more hikes are coming (which may bring fixed rates higher again) — or if they do decide to hold firm and allow time for the market to respond, inverted rates may remain for a little while longer.

Watching rates? Here is the Bank of Canada's 2023 Schedule for rate announcements:

- Wednesday, January 25

- Wednesday, March 8

- Wednesday, April 12

- Wednesday, June 7

- Wednesday, July 12

- Wednesday, September 6

- Wednesday, October 25

- Wednesday, December 6

Compare Rates and Save

Save over 5 years:

A lower rate gives you more savings than merely a lower monthly payment. The real savings is both the interest saved, plus the additional principal paid down over the term.

Various tools and functions of this website perform calculations and provide cost estimates. These tools are designed for illustrative purposes only and make many assumptions that may not reflect all situations. Please use these tools in collaboration with a True North Mortgage agent. True North Mortgage does not guarantee the accuracy, reliability or completeness of these tools or calculations.

Across our great nation, your best mortgage rates and service are right here.

We really know mortgages, what do you need?

What is portability?

If you move, can your mortgage (and rate) come, too? Learn about this feature.

Worried about your renewal?

Higher rates painting you into a budget corner? Get help to find a way out.

First-Time Home Buyers

Get the best start and save a pile of cash with our mortgage experts.