Here's a reminder of variable-rate benefits.

Despite suffering the equivalent of 19 rate hikes (0.25% increments) between March 2022 and June 2024, the narrative has suddenly shifted back to the benefits this rate type offers during a period of declining rates:

- Instant budget relief with each variable rate drop by the Bank of Canada — if you choose an adjusting-payment variable mortgage (ARM).

- Your amortization reduced with each rate drop, helping you pay off your mortgage faster — if you have a fixed-payment variable mortgage with a big bank (VRM).

- Historically, a variable rate tends to save homeowners more over the life of a mortgage.

- With a variable-rate product, you have more options, like

- The flexibility to lock into a fixed rate at any time, penalty-free.

- Paying a lot less penalty than a fixed-rate mortgage if you decide to switch lenders.

How fast (or far) might variable rates fall?

Your variable rate reflects the discount off prime your lender offered for your contract rate, which stays put for your 5-year term.

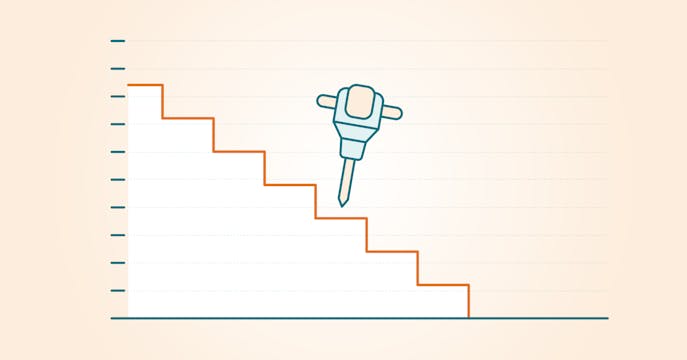

Bank prime rates have already dropped 2.25% from the peak of 7.20%.

With a continuing trade war — or settling on increased U.S. tariffs for certain Canadian goods — True North Mortgage CEO Dan Eisner predicts prime rates might fall by another 2 to 5 rate cuts, from a current BoC policy rate of 3.0% to at least 2.25% by the end of 2025 (for a prime rate of least 4.45%, assuming the current spread with the policy rate of +2.20%).

Before tariffs, markets had expected another two prime rate cuts this year. Economic conditions are expected to be volatile this year, grappling with politically charged aspects that could impact the Canadian economy, both in the near and far term.

(In a tougher economic environment — such as a tariff-triggered recession — variable discounts offered for renewals or home purchases may shrink as lenders deal with increased operating costs.)

The amount variable rates could fall during your term would (obviously) affect how much you'd save vs. choosing a fixed rate right now.

You should know that variable rates are normally lower than fixed rates.

We've been living in the (rate) upside-down for the last couple of years.

Homeowners are looking at the current variable rate, and it's still higher than our best 5-year fixed rate. Typically, variable rates are lower than 5-year fixed rates by a spread of anywhere from 0.25 to 1.0% (during the pandemic, the spread increased to around 1.5%).

At some point soon, the natural (rate) order of things will reassert and variable rates will return to being lower than a 5-year fixed rate.