Should you early-renew now to save more later?

With the dawn of rising rates, breaking your 5-year term early to lock in today’s rate may be worth your while. We'll help unearth the best mortgage scenario for your savings.

You know what they say — the early bird gets the worm.

In this case, the worm is the possible savings you might reap by locking in at today’s lower fixed rate for another full term, rather than waiting for your renewal period to come up in a year or so, when rates may be a lot higher.

The early bird part, though? Breaking your mortgage early to renegotiate your rate means you’ll pay a penalty to the lender. That’s assuming you have a closed mortgage term, like most Canadian homeowners, instead of an open one. But depending on the rate difference and penalty cost, you may come out ahead to save more cash down the (mortgage) road.

As we all know, rates are flying up.

Fixed mortgage rates have already flown upwards from their early-2021 rock-bottom status, influenced by accelerating bond yields. Many financial experts (with their crystal balls working full-bore) are projecting the increases to continue amid high inflation, peaking sometime within the next couple of years.

If you’re a few years into your term, take a look at where True North Mortgage's rates are now, and estimate where you think they may be in a few months, or even a year or two (use our Rate Comparison calculator to see some numbers). The savings can start to rack up as the rate difference widens — not just a few dollars, but thousands, real money that can help out when everything else is also going up.

By locking into a lower rate now for a 5-year term, you’ll be protected from further hikes during that time, which may be worth the penalty cost. Whereas, if you wait for your renewal period when rates are possibly peaking, you'll have no choice but to accept that higher rate over your next term and pay more. Plus, if rates end up staying high for too long, you won't be able to 'early renew' back to a lower rate during your term to catch a budget break.

What penalties might you pay with an early renewal?

Breaking your fixed-rate mortgage will cost the greater of 3-months interest or the lender’s IRD calculation (Interest Rate Differential); it’s typically the latter. And it’s here that your lender’s mortgage fine-print really matters — the penalty calculation could be reasonable, making your early renewal a sound strategy to save more.

But, if you signed up for a bona-fide sale clause, or if the ‘big bank’ penalty is too high, an early rate break may not make financial sense. Plus, if you’re with a big bank at their rate, not your best rate (through us), you may also find that there’s not enough rate difference to bother kicking up the dirt.

It’s never been more important to have an expert broker by your (mortgage) side.

Want simple answers and clearer rate decisions? We know our way around the mortgage fine print and can help unearth your true costs. You’ll get a clearer understanding of how your rate and pre-payment penalties may affect your mortgage finances. And, you get the advantage, because our unified, salaried brokers can pass along a rate discount while accessing thousands of products from different lenders (including the big banks) to offer you your best, most transparent deal.

The right advice on your mortgage can mean a lot, now and later.

Having your best rate, along with the flexible mortgage options you need, can help you deal with life as it happens – so that changes don’t end up costing you both time and money when you least expect it.

Worried about rising rates? Or want extra funds along with your early renewal?

Get all your mortgage ducks in a row with great advice — at no cost or obligation. Click our chat bubble, give us a call, or apply online to instantly connect with a highly-trained True North Mortgage broker. Anywhere you are in Canada, we're standing by to help.

The early bird gets the (mortgage) savings.

More ways to save $$$

Proof that our rates are lower.

Our rates are 0.18% lower on average compared to everyone else. Prove it? Okay!

Learn More

Push 'pause' on your rising rates.

Times are a changin' — rates are blasting off, hold yours now!

Learn More

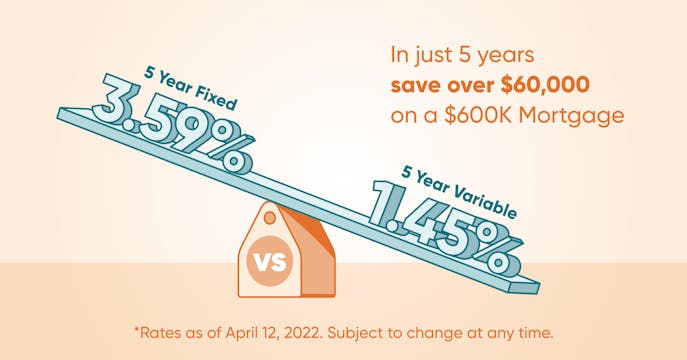

Save a year's salary with a variable rate?

Variable-rate savings have been turning heads. But is it right for you?

Learn More