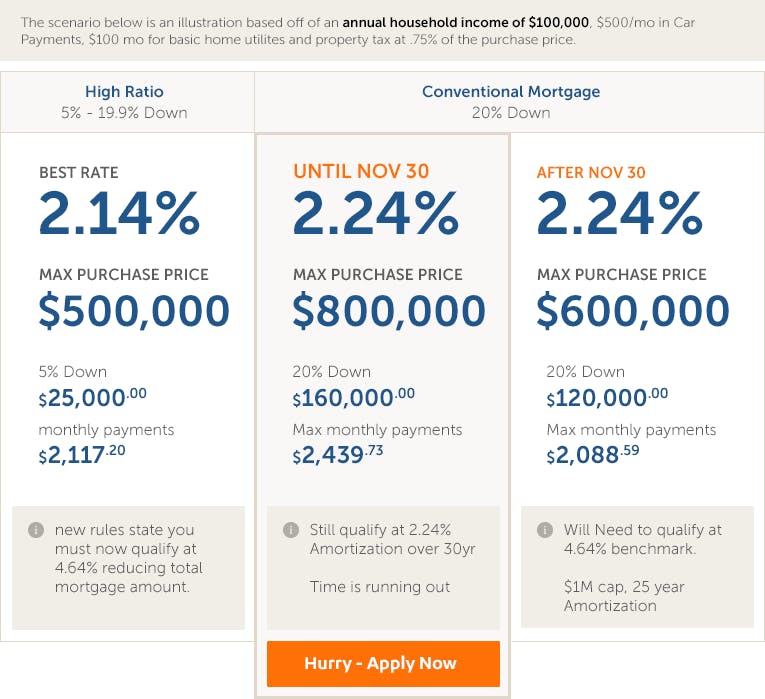

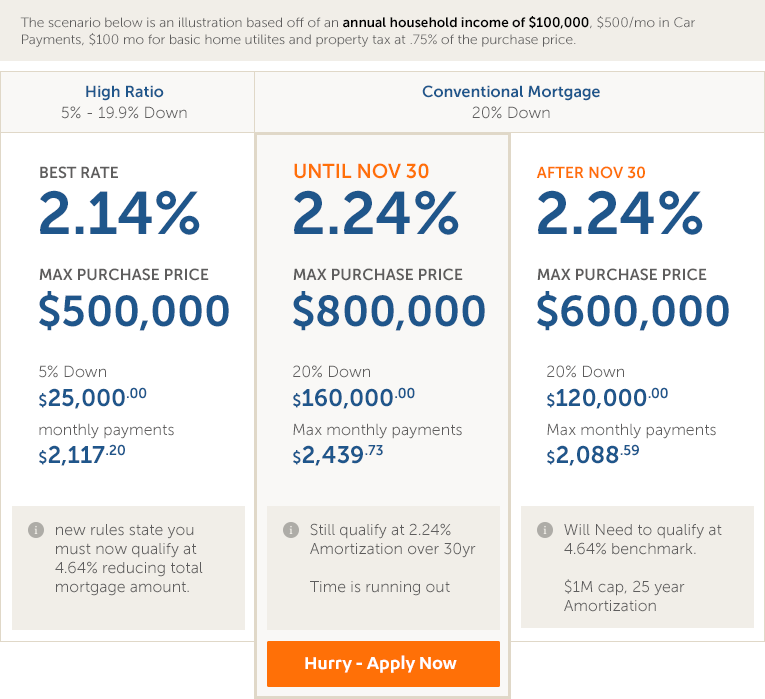

What can you afford with new mortgage rules in 2016?

The October and November 2016 federal rule changes may affect how much you can borrow for your mortgage loan. Talk to us today for your best options and rates.

The federal government is changing mortgage rules to help ensure that Canadian home owners will be able to afford their mortgages if rates go up. You must now be able to qualify for a rate of at least 4.64%.

- Affects high-ratio mortgages (less than 20% down payment) starting October 17, 2016

- Affects conventional mortgages (20% down or more) starting November 30, 2016

The rule change taking effect November 30 will impact the amount you can qualify for with Monoline lenders. These mortgage-only lenders typically offer the lowest rates and most flexible terms.

Although we still offer the best mortgage rates, with this rule in place, your borrowing capacity is effectively reduced by nearly 25%. Read more about how it will affect refinancing rates, as well.

Apply now to secure a higher purchasing price under the current rules. We'll help answer any questions, outline your available options, and take you through the mortgage process, stress-free.

Note: Illustrative purposes only. Please contact a True North Mortgage broker today to learn about your available options and for the most accurate information for your situation.