Have variable rates peaked?

If you're considering getting a variable-rate mortgage now, with fixed payments or floating payments, it's more likely that you'll pay off your mortgage faster or see monthly budget breaks if rates fall during your term.

They may. Or they may not.

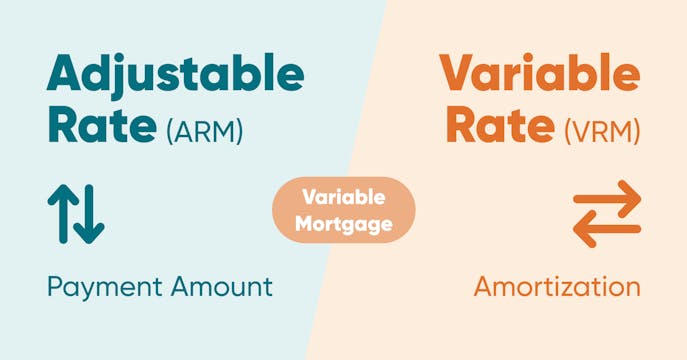

The type of variable-rate mortgage you have (adjustable vs. fixed payments) determines whether you can actually get a budget break during your term.

Some of our clients prefer a variable-rate mortgage (okay, maybe not as much during this unusual skyrocketing-rates cycle) because they typically outperform fixed-rate mortgages over time.

When rates drop, if you have an ARM (adjustable-rate mortgage), your payments will adjust lower along with the lowered variable rate. You'll appreciate smaller mortgage payments and a budget break.

But — if you've hung on with a big-bank VRM product that has fixed payments (the amortization adjusts instead), it means that your payments won't change, and you may not be able to request lower payments when rates decrease.

Here's why, and what you need to know to keep your mortgage goals on track.

Your fixed payments can help you keep some budget sanity during a time of rate increases. But your amortization (total duration to pay off your mortgage) is ticking up the entire time to adjust to higher rates, with a bigger portion of your mortgage payment going to interest, not the principal.

The more your amortization ticks up, the more likely you'll be in for a payment shock at renewal if the lender has to squeeze your much longer amortization back to what it should be, resulting in higher payments for your next term.

A longer amortization means that when rates drop, that's what goes lower instead of your payment. The longer it is, the longer it will take to return to where your mortgage loan length is supposed to be, in line with your original payment ratio of interest to principal.

So, asking your bank to lower your VRM's fixed mortgage payment to reflect lower interest rates will likely only get you a blank (bank) stare in return.

Yes, that's better than the opposite (lengthening increases your mortgage costs).

But it also depends on how much your mortgage time has already increased. Depending on how much time is left in your term, even when rates decline, the amortization may not have enough time before renewal to shorten back to actual to avoid higher payments.

Regardless of where variable interest rates are, however, you can still take action during your term to reduce your amortization — to help keep your mortgage goals intact.

With an increased mortgage length due to interest-rate increases, you can bring your amortization back in line by:

We highly encourage you to contact your lender or expert broker for the best options that fit your mortgage details.

Your fixed payment VRM may have certain restrictions that interfere with this type of payment change, even if variable rates fall (though you may be able to change your payment frequency; fees may apply).

Depending on the lender, resetting your payment may only be possible through a refinance, which can incur a penalty to break your mortgage and start a new one.

If you've pre-paid enough down on your mortgage principal, your mortgage fine print may allow a recast for lower payments during your term (our in-house lender, THINK Financial allows a recast with their ARM variable product).

There are almost $380 billion variable-rate uninsured mortgages outstanding, with somewhere in the vicinity of $260 billion that have amortization periods greater than 35 years.

– RBC Report : Canadian Banks, October 2023

Did you get your fixed-payment, variable-rate mortgage — and haven't checked in since rates went up?

Now's the time to see what's what for a firm understanding of how your mortgage will progress by the time you need to renew.

For example, many homeowners got a VRM in 2021 before rates skyrocketed. With a renewal not coming up until 2026, they may think there's still plenty of time for rates to decrease and allow amortizations to recover.

However, RBC's report suggests that interest rates would have to hit rock bottom by 2026 (down to 0.25%) just to reduce the payment shock at renewal to around 20% from as high as 84% (depending on the variable-rate mortgage details). Considering the central bank's rate mantra of 'higher for longer,' that very low rate is not likely to happen (for quite a while).

Experts predict rates may eventually come down to rest around 3.0%, a neutral rate that would neither stimulate nor suppress the economy, which won't be enough to erase the cumulative impact of these current high rates on amortizations for these products.

Long before 2026 appears, these variable-rate mortgagees may hit their trigger rate (which lies in the mortgage fine print) — when the payment no longer covers the interest owed and the mortgage balance itself starts to increase (referred to as negatively amortizing).

So ignoring your VRM and hoping it all goes away isn't a sound strategy to help you save or avoid the budget stress you could face with payments that may be hundreds of dollars more when it's time to renew.

Planning now can help you get ahead for (mortgage) peace of mind.

If you're considering getting a variable-rate mortgage now, with fixed payments or floating payments, it's more likely that you'll pay off your mortgage faster or see monthly budget breaks if rates fall during your term.

A fixed payment variable-rate product has helped many homeowners maintain their monthly budgets while paying off their mortgages, weathering smaller up-and-down prime rate movements.

Unfortunately, the fastest rate hike cycle since the 1990s has brought this product into the spotlight for its potentially detrimental effect on financial goals.

But it also may have given homeowners a chance to adjust their budgets on their own, going to their bank when they're able to handle higher payments — for example, after receiving a pay raise or placing a lump sum down to keep their amortizations within reach.

With the adjusting payment of the ARM, there's little time to adjust to a higher payment with each rate rise (though doing so has kept those amortizations in step with paying down their home loan).

The important thing we can't stress enough is to keep in touch with your broker, ask questions, and consider your options to help keep the higher-rate stress at bay.

Your best rate and mortgage can help you save thousands. Our expert brokers are highly trained and can access several lenders and products to ensure you have flexibility with fewer fees, and your lowest rate to keep more money in your pocket.

Hear something ticking? Take a moment (with us) to assess your mortgage needs.

Learn More

Which rate type works best for you, variable or fixed? Some pros and cons to help you decide.

Learn More

Payments that change along with the prime rate may be better for your mortgage savings.

Learn More