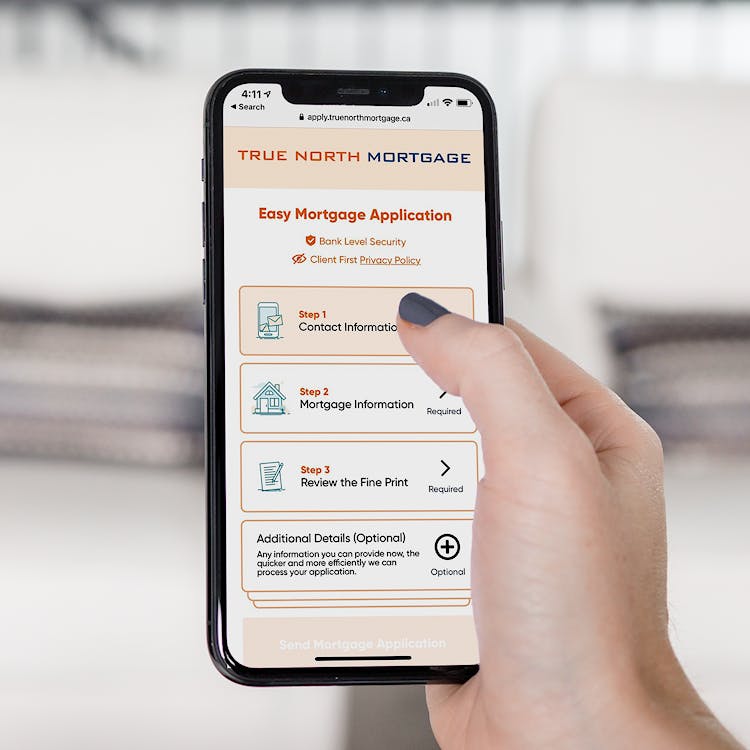

Easy Online Mortgage Application

Make your (mortgage) life a little easier.

Want to buy a home or renew with your best rate? Whatever your mortgage needs — get your pre-approval all done online. Our application is easy, clear and goes where you do.

Not all mortgage applications are created equal.

Our on-the-go, online mortgage application makes it so easy for you to apply and then connect with an expert broker:

- Convenient and super simple to use

- Finish your application now, or later when you have more time. Our form saves the info for 14 days (no need to make an account)

- You can start on your phone, pick it up later on your desktop or iPad, and take it back to your phone

Even better than our user-friendly online application? Our knowledgeable, friendly brokers. We're here for you, anywhere you are in Canada.

Apply Form FAQ's

We know you're busy, and may not complete your online application in one go. So, we temporarily save your data as you progress through the form. On the same device, you can close your browser and return to your form for the next 14 days. If you choose to 'hand off' your partially complete application to fill out on another device, your form can be accessed on both devices for 14 days from when you first started your application. Each time you come back to answer more questions, your form will reset to a new 14-day window.

If you start your application form on your phone, but then want to answer the next set of questions on your laptop, you would 'request a handoff' email from your phone, then open the link on your laptop and continue to work on your application. Now, on both devices, you can access the contents from the version you initially started on your phone. Under 'My Data Settings' at the bottom of the application you will find the button to send the handoff email. You will need cookies enabled on both devices.

During the 14 day period, we may send you automatic reminder emails if your form hasn't been submitted and/or before automatically deleting your incomplete form. Typically, these reminder emails are triggered 3-4 hours after you've started (but not submitted) your application and again after 13 days if you haven't submitted your form.

You can disable the reminder emails in 'My Data Settings' at the bottom of the application. Please note that if you have previously unsubscribed from our email marketing list, submitted a recent application, or talked to a broker, you won't receive these reminder emails. You can still manually trigger a handoff email, which should be sent within 1 minute and sent regardless of your subscription status. This email trigger will not change your subscription status for our marketing emails.

In our application form, under 'My Data Settings' (bottom of the application) you can disallow reminder emails. These reminder emails are considered transactional, rather than for marketing purposes. But please note that automatic reminder emails are NOT sent to you if you have previously unsubscribed from our email marketing list. If you want to unsubscribe from all emails, you can do so here.

Yes. We use bank-level security and audit our systems regularly. We never sell data to third parties. After 14 days your temporary data is deleted (we may send you a reminder email before we do that). Once an application has been submitted, we process your mortgage application and keep it securely on file. For more information, please review our Privacy Policy and Service Agreement.

For your mortgage pre-approval, you'll need to answer certain questions and provide financial info and related documents.

You can fill out a little bit, or advance through the stages to complete the full application form. Once you fill out your contact info and basic mortgage needs, and agree to the terms, you may at that point submit your application. An expert broker will be in touch shortly to help finish your pre-approval and answer any questions.

If you continue to fill out more of the optional info, it will speed up the process and we won't need to ask as many questions over the phone. To see what info and documents you'll need to supply, check out our Mortgage Checklist.

As soon as you hit 'submit,' your application form goes right to an expert broker in your area, who will contact you shockingly fast (typically within business hours) to answer any questions and to complete your mortgage pre-approval process.

This contact is important, because it means you have a highly-trained mortgage specialist who will help you secure your best mortgage rate and the right mortgage product for your particular situation, based on your application. Plus, it's a relationship you can come back to — we're always here for your future mortgage needs.

Once you submit your application with True North Mortgage, your expert mortgage broker will quickly assess your situation, and, using the latest mortgage stress-test regulations, provide the right lender and rate to save you as much as possible on your mortgage. This advice includes first-time home buyer programs and rebates, and other ways to save on fees and possible future pre-payment penalties.

Once you submit your application with True North Mortgage, your full mortgage pre-approval may take from a few minutes up to two weeks, depending on your situation and the documents and information you provided. For example, if you're self-employed, there are different requirements and specific lenders programs, which may take more time for a pre-approval to be finalized.

At True North Mortgage, you can apply with us online, over email, over the phone, through our chat, or in person at one of our store locations. We want to make your mortgage process and experience as easy and seamless as possible, which is why we offer so many ways to help you get your best rate and mortgage fit.

Apply online now, for your better mortgage experience.

Try our other helpful tools

Compare & Save Calculator

See for yourself how much you can save with our lower rates.

Affordability Calculator

How much home can you afford?

Mortgage Payment Calculator

See what your monthly payment could be, with our quick and accurate calculator.

Useful mortgage info

Pre-Qualify in Minutes

Know before you go (house hunting, that is). Get pre-approved fast, hold your best rate.

First Time Home Buyers

Get the best start and save a pile of cash with our mortgage experts.

Proof that our rates are lower.

Our rates are 0.18% lower on average compared to everyone else. Prove it? Okay!